Micro, small and medium enterprises sector contributes to 48% of India’s exports. They also prove to be energy-intensive and account for 40% of the low carbon businesses in 2018. MSMEs have the pivotal potential to drive India towards a low carbon and sustainable economy. They are pulled back by the low technology and financial constraints. Given that the MSME Ministry has set its sail for the mega transformation to account for 50% in the GDP from 29% at present. It is evident this is the era of MSMEs. And that is why Involuntary Carbon Markets can also help in achieving the bar set by the Ministry. It supports the economic development, creates significant job opportunities and not to forget it also helps us stick to our 2℃ Nationally Determined Contributions promised in the Paris Agreement. India’s Climate goals also include the reduction of GHG emission intensity by 33%-35% by 2030 as per 2005 as the baseline. Our country also targets to install 175 GW of renewables by 2022 thereby targeting 40% of non-fossil fuel energy sources by 2030.

Keeping all this in mind, we would like to bring to the MSMEs, the concept of Carbon Markets, Key players, a sneak peek into the working of it, how it could be a financial aid and carbon pricing and its significance to our environmental protection, climate change mitigation and adaptation measures.

Terminologies in Carbon Market:

Carbon offset – Reduction/ removal or avoidance of GHG emission. 1 Carbon offset = 1 tCO2e reduced.

Carbon credit – Tradable certificate representing the reduction of emission that could be sold to an entity unable to lower its emissions.

Carbon Market – So, this is the platform where all the transactions such as selling and buying of the carbon credits take place. There are two types of Carbon Markets namely

1.) Mandatory Carbon Market – Mandated by the governmental entity to cap and trade the emissions to attain climate goals. Hence certain emission-intensive industries are at the need to comply with the regulations. They can either make an actual reduction or buy carbon credits.

2.) Voluntary Carbon Market – Participation in reducing emissions is completely voluntary. Say the company by itself targets to attain carbon neutrality, corporate CSR by making actual reductions or buying carbon credits.

So, Key Players would be:

Project Developer – The developer of any project from renewable energy projects, afforestation, promoting electric vehicles to providing safe drinking water that cuts the necessity to boil the water before consumption. Thereby reducing significant amounts of emissions.

If you look at these projects closely, the main aim of the projects is not a reduction in emissions. It is an added benefit. And that the finance created via this is necessary. This is known as additionality.

Validator – The project developer gets his project to be validated, monitored and evaluated by the Validators/Verifiers/Third party who are in association with the Registry.

Registry – The project developer aims to get his project registered in the registry/Organization after validation, monitoring and evaluation. Eventually to attain the carbon credit certificate that could be sold. Few examples of registries are Verra Carbon Standards, Gold Standards.

Aggregator/Middle Men/Intermediaries – These intermediaries are an organization/entity/individual that facilitates the transaction for a fee.

Buyer – The buyer is an organization/industry that is interested in purchasing carbon credits to comply with their emission targets.

How does it work?

Let’s say we have a project in mind. How and when would it make into Carbon Market? There are factors that our project should comply with.

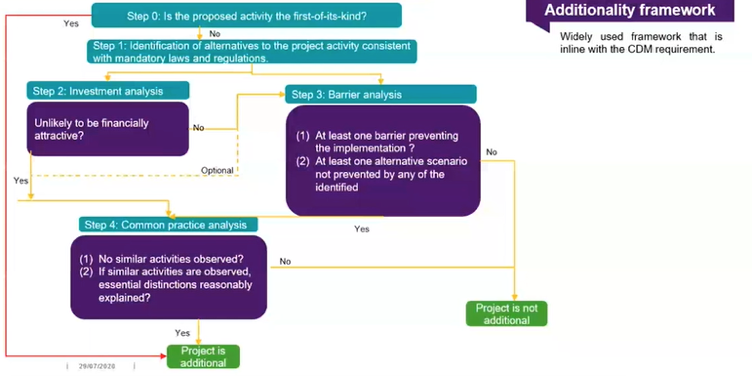

Additionality – The project should showcase emissions reduced when compared to Business as Usual scenario. And as mentioned above, the reduction in emissions is an added benefit. If the project is one of its kind, then yes! The project is additional. It is not additionality if it’s mandated by government bodies/ frameworks/ regulations. Also that the financial aid that the carbon credits provide us with is necessary to compete with the technological, institutional, investment barriers of the project.

For a clearer view, here is how we investigate the additionality of the project.

End to End

Project Idea Note and Project Design:

We have a project plan. We check for its feasibility with the additionality. Analysis of the impacts and risk assessments of the project. Though it claims to reduce emissions, it may also carry other drastic effects on the environment. Have you considered the Stakeholders of the project location? This puts under the spotlight the social aspects and societal benefits that could be derived from the projects.

The Project Design Details are commenced. The quantification of the emissions, monitoring of the social and environmental benefits are clearly planned.

Validation and Registration:

The third-party/Validator checks for the baseline scenarios, monitoring plans, methodologies adopted and gets back to the project developer for corrective actions and resubmission if necessary. Then takes it to the registry for registration.

Verification and Issuance:

The validated project has to be implemented. Then actual reductions and estimations have to be made. Every verification we opt for from the validators accredited by the registry has a cost. Hence usually as per the project’s crediting period one adopts the verification frequency. Usually, once a year is adopted for ease in the documentation. Once the verification proves that the reductions are actually made, the credits are issued.

Credit Retirement:

The VERs (Verified Emission Reductions) is issued to the developer. It could be sold to an aggregator or the end buyer. When sold, the carbon credits are said to be retired.

Vintage Year:

It is the year in which the reductions have occurred. Usually, the buyers opt for recent vintage years. As a fact that the old carbon credits that are still in the market outs forth the question of quality of the carbon credits.

Crediting Period:

It is the entire period for which the project can generate carbon credits. For example, forestry projects have larger crediting periods of 100 years.

Carbon Pricing:

The price of the carbon credits varies. The variability depends on the type of project, the societal and environmental benefits that come along with the emission reductions. Entities/Organizations/Buyers are not just into the carbon credits. The carbon credits are of more quality and value with the societal and environmental benefits it brings along.

For example, let us look into the cost survey by Gold Standards (Registry):

In a Forestry Project:

The investment made – US $ 432

Verified Emission Reductions issued – 24 i.e. US $ 18/VERs

Additional values:

Due to forest restoration + decrease in deforestation = US $ 3,600

Jobs on agroforestry farms and in the management of forest conservation areas = US $ 648

Tonnes of GHG mitigated-average emissions per capita in the US = 24 tonnes of CO2

Total value created = US $ 4,248

Total value created = US $ 4,248

Voluntary Carbon Market in India:

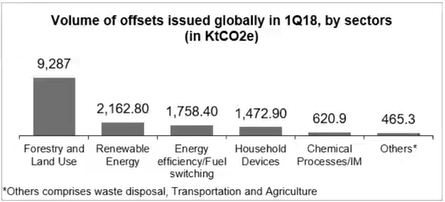

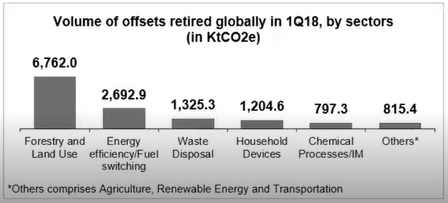

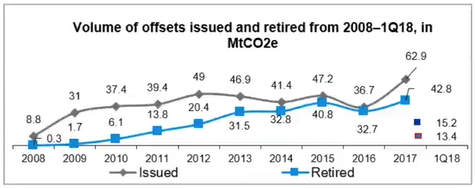

The offset issuances and their retirements have both picked a better pace over the years. About 72% of the voluntary carbon offsets were made in India, China, US, Turkey, Brazil in 2018. And given the statistics that the Carbon markets are at the better phase, now would be the apt time for the green start-ups and MSMEs in India to venture into it.

As discussed above, it’s not just about reducing emissions by any means or buying and selling of carbon credits. It has supplemental benefits of complying with the Climate targets, the addition of value via conservation/restoration of biodiversity, raising the living standards of the locality in which the project is developed.

Written by: Rasiga Selvaganesan

References:

- India GHG Program

- MSME Sector poised for mega transformation in 2020 | The Economic Times | Rise | 30 December 2019

- GiZ Voluntary carbon markets | Basic & Advanced Training Workshop | 29 July 2020

Image credits: